Micro, Small and Medium-sized Enterprise Status in the EU and UK

by Dr Bethany Aykroyd, Consultant

Introduction

Micro, small and medium-sized enterprises (SMEs) are valuable sources of pharmaceutical innovation. In 2020, nearly 20% of all human medicines recommended for authorisation were developed by SMEs, with half of these targeting rare diseases.

To promote the development of new medicines, regulatory agencies, including the European Medicines Agency (EMA) and the Medicines and Healthcare products Regulatory Agency (MHRA), have developed initiatives to support SMEs. Enterprises that meet the definition of an SME are eligible for a wide range of benefits, including financial incentives such as a 90% fee reduction for scientific advice with the EMA (saving in excess of 90,000 Euro for some initial advice procedures) and payment easements for marketing authorisation (MA) applications with the MHRA.

SME Status with The EMA

EMA SME status criteria.

The EMA follows the EU definition of SMEs which is set out in the Commission recommendation 2003/361/EC and came into effect from 1 January 2005. The main factors determining whether an enterprise qualifies for SME status with the EMA are employee headcount, plus annual turnover or annual balance sheet total. The enterprise must employ less than 250 employees with an annual turnover of not more than 50 million Euro or an annual balance-sheet total of not more than 43 million Euro. The specific SME threshold criteria are outlined below in Figure 1.

If an enterprise has recently been founded and does not have finalised financial reports, estimates can be provided to the EMA SME Office for the reference period which is being declared, along with an estimation for when the enterprise will be able to provide the first annual accounts.

Figure 1. SME thresholds, Commission recommendation 2003/361/EC

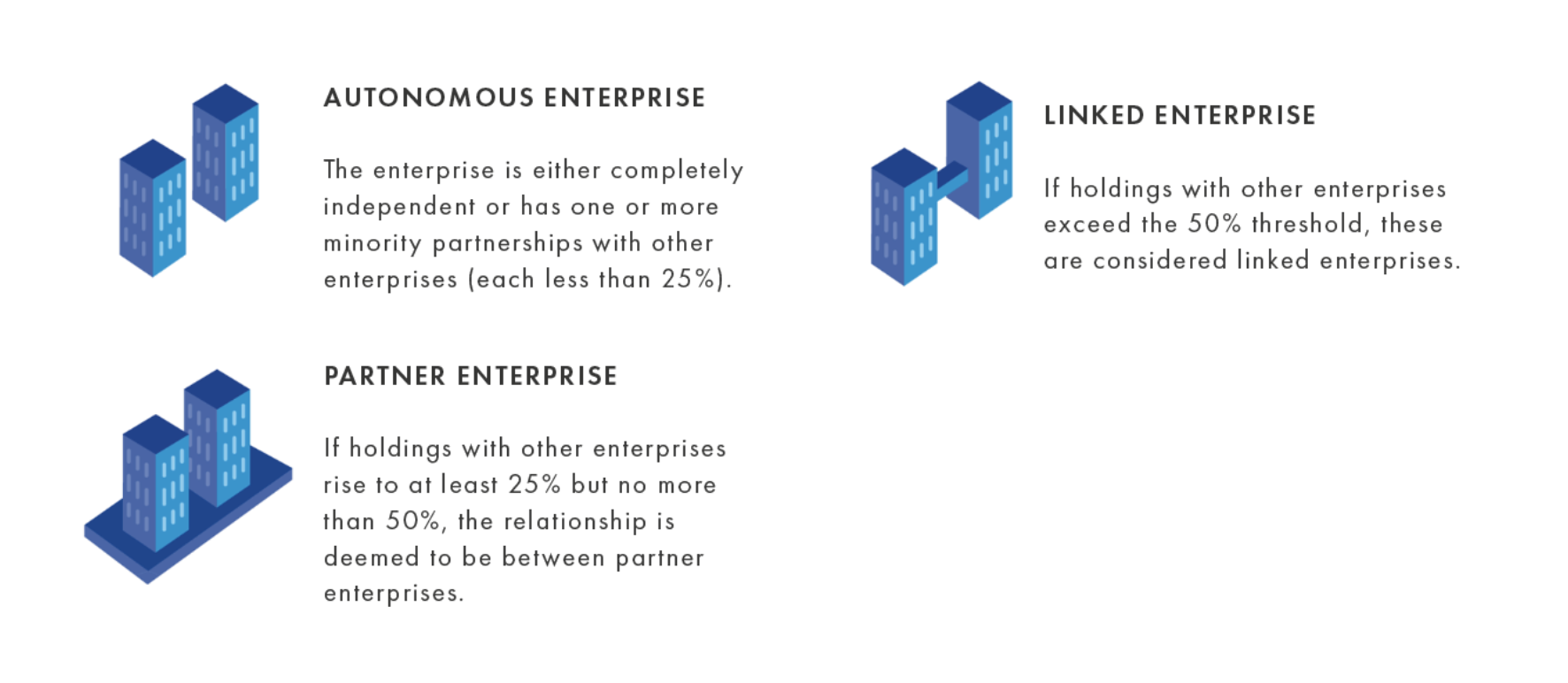

In addition to size, enterprises are also classified according to their category: autonomous (the most common category), partner or linked (Figure 2).

Depending on the category an enterprise aligns with, a proportion or all of the headcount and financial data from a partner or linked enterprise may need to be considered. For instance, SME status may not be granted to a small enterprise if it has access to substantial additional resources because it is partnered with, owned by or linked to a large enterprise.

Figure 2. SME enterprise categories

In addition to size, enterprises are also classified according to their category: autonomous (the most common category), partner or linked (Figure 2).

Enterprises must be based in the European Economic Area (EEA) to be eligible for SME status with the EMA. However, non-EEA based enterprises can benefit indirectly through an EU/EAA established regulatory consultancy that has SME status (provided the criteria thresholds outlined above are still be met). Scendea offers this service through our office based in the Netherlands.

Following approval of SME status with the EMA, the EMA SME Office will issue the enterprise with an EMA-SME number. From this point, the enterprise can take advantage of administrative, regulatory and financial support provided by the EMA.

EMA SME Status Incentives

The regulation behind the EMA’s SME incentives is Commission Regulation (EC) No 2049/2005 which was adopted on 15 December 2005.

Administrative support.

Registered SME’s can contact the EMA’s SME Office for guidance regarding administrative requirements, regulations or procedures. SMEs can also request a briefing meeting to discuss regulatory strategy for product development or to engage in early dialogue with the multidisciplinary team at the EMA.

Other benefits include free-of-charge translations of the product information into all of the official EU languages (excluding Icelandic and Norwegian) for initial EU MAs. The MedDRA licensing fee when registering with EudraVigilance is also waived for micro- or small enterprises (not for medium-sized enterprises).

Fee incentives.

The fee reductions/deferrals are particularly valuable for EMA SME status holders. The substantial 90% fee reduction for scientific advice (saving over 90,000 Euro for initial advice) was designed to encourage SMEs to seek advice from scientific experts at the EMA regarding any issues linked the development of new medicinal products. This is aimed to maximise the chances of a successful MA. A 90% fee reduction is also granted for any Good Manufacturing Practice (GMP), Good Laboratory Practice (GLP), Good Clinical Practice (GCP) or pharmacovigilance inspections that are requested by the EMA.

For a small enterprise, the fee owed to the EMA for reviewing a Marketing Authorisation Application (MAA) may be a financial strain. To relieve this constraint, SME status holders have the option to defer fee payments by up to 45 days after the date of notification of the centralised MA, or within 45 days from the date of notification of withdrawal. In the case of a negative outcome, if scientific advice was sought from the EMA and taken into account when developing the medicinal product, the MAA fee will be fully waived by the EMA.

A summary of the fee incentives for enterprises with SME status with the EMA are shown in Table 1.

Table 1. Fee incentives available to EMA SME status holders

SME Status With The MHRA

The criteria used to define SMEs by the MHRA is slightly different to the EMA’s definitions. The eligibility thresholds used by the MHRA are defined by the Companies Act 2006 and are outlined in Table 2.

Following the submission of an SME status application, the MHRA’s Finance department will assess the application and confirm whether an enterprise meets the necessary requirements. Once SME status is confirmed by the MHRA, the enterprise is eligible to receive relevant easements or waivers from the MHRA. The extent these depends on the size classification of the enterprise.

Table 2. MHRA SME thresholds, Companies Act 2006

Payment Easements Available for Small Companies

Major applications

25% of the application fee for a new active substance at the time of the application with the remaining 75% payable within 30 days of the MA being determined.

Complex applications

50% of the application fee for a new active substance at the time of the application with the remaining 50% payable within 30 days of the MA being determined.

Applications for Manufacturers’ or Wholesale Dealer’s licences

50% at time of application with 50% payable 12 months after that time.

The “50% rule” at time of application then 50% payable 12 months after also applies to the payment of applications for traditional herbal medicines registrations and applications for complex variations to traditional herbal registrations.

In respect to inspection fees in connection with applications for a MA, traditional herbal registration, manufacturer’s licence, manufacturer’s authorisation or wholesale dealer’s licence, the fee payable is 50% within 14 days following receipt of written notice requiring those fees, with 50% payable 12 months after that date.

Payment Waivers Available for Small & Medium Companies

Fees payable in connection with a meeting mentioned in any of regulations 4 to 10, as set out in the Human Medicines (Amendment etc.) (EU Exit) Regulations 2020.

100% of initial application fee where the licensing authority grants an orphan MA.

100% of application for variation of orphan MA made within first 12 months of the date of grant.

Maintenance of SME status

An enterprise’s SME status expires two years after the date of closure of the accounts on which the declaration was based. Any of the following changes must be declared with the renewal application:

A change in the type of the enterprise (autonomous, partner, linked). This may be due to significant changes in the upstream or downstream ownership structure (e.g. acquisition, takeover, liquidation, merger of the applicant and its partner/ linked entities).

If the SME thresholds have been exceeded.

How Scendea Can Help Your Company Obtain and Maintain SME Status With The EMA and/or MHRA

Scendea NL is registered with the EMA as an SME. This allows our non-EU based clients, that otherwise meet the EMA’s SME eligibility criteria, to append to our own SME status and access the EMA’s SME benefits. This low-cost activity can be completed within approximately 6 weeks. Applying for SME status well before your first interaction with the EMA will ensure SME status with the EMA is in place before proceeding with scientific advice so that the substantial 90% fee reduction can be accessed.

Additionally, if you are a UK-based company that meets the eligibility criteria, we can support your company by preparing the SME application and providing guidance on how to submit the application to the MHRA. Once SME status is obtained, this will allow you to access the applicable benefits and fee incentives to support your ongoing and future development programmes. Scendea will also be there to support you when it is time to evaluate your suitability to renew your SME status so that you can continue to access the relevant benefits.

If you believe that your enterprise qualifies as an SME, please get in touch with Scendea’s expert consulting team for support with obtaining SME status with the EMA and/or MHRA to make the most out of the incentives and benefits that are available to you.